INVESTMENT SUMMARY

Our experience in the hospitality industry is extensive. We are seasoned operators with a long track record of very successful venues. Cirque principal Dale Polselli brings nearly 2 decades of experience to the company, developing and operating a wide range of food, beverage and nightlife/ entertainment concepts throughout San Diego.

We are a firm that emphasizes innovation and thought leadership in every project. Through up and down economies, we have consistently demonstrated the ability to deliver highly profitable venues. Some of our projects include 4th&B/Club Ultra, The Saloon and Shelter. At 4th&B/Club Ultra we took revenue from $1.6m to well over $5m, booking high profile events and mega performances with the likes of Kanye West, Tiesto and Depeche Mode to name just a few. With The Saloon, we grew revenue from $560k to $1.3m, with profit margins north of 30% and became a hotspot for influencers, professional athletes and celebrities including Emily Ratajkowski and Danny Way. At SHELTER, we built an ultra stylish and highly profitable cocktail lounge and nightlife venue that set the standard for North County nightlife and entertainment.

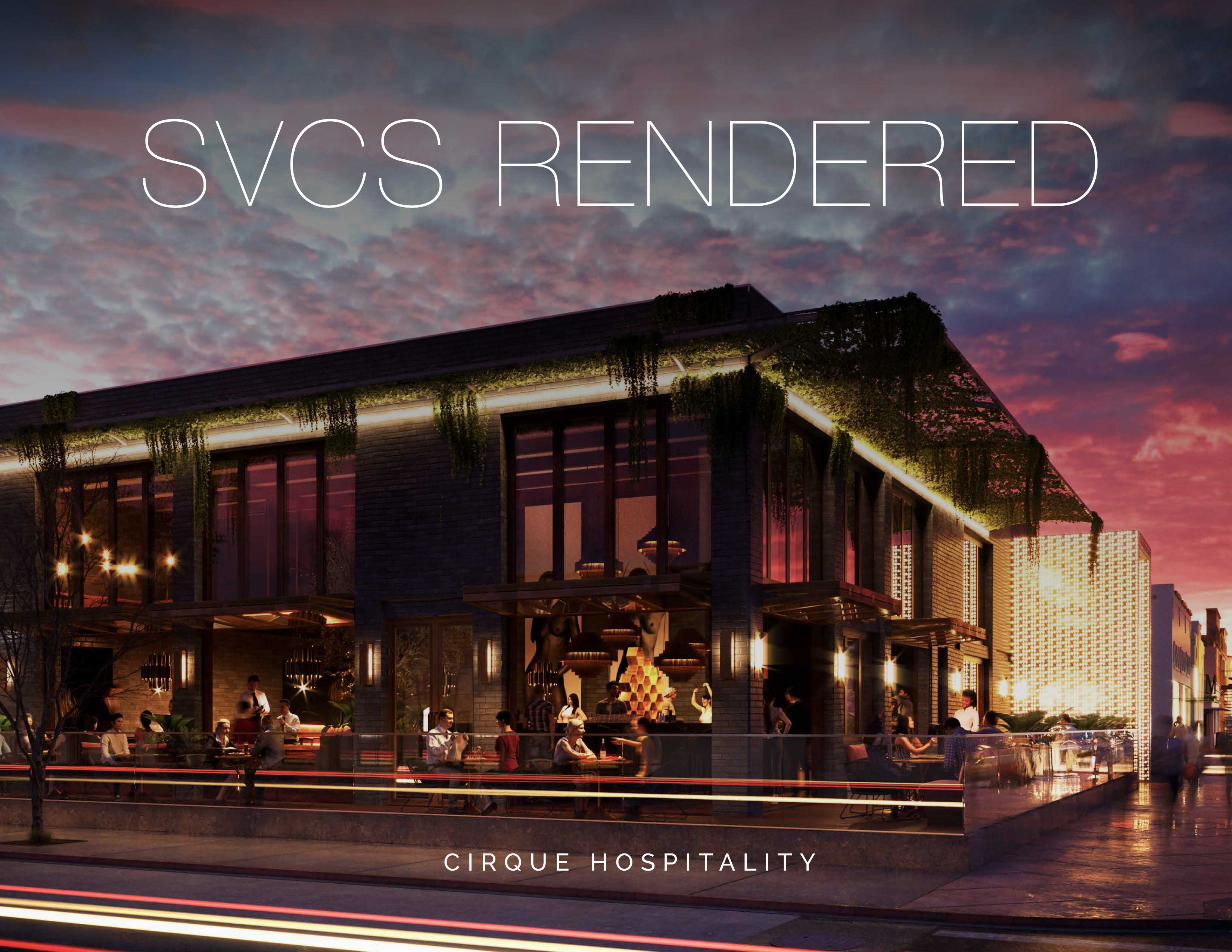

Our SVCS RENDERED project in North Park is the evolution of our highly successful SHELTER concept, and will blend together exceptional nightlife, entertainment, social dining, mixology and special event experiences in an elevated, stylish atmosphere.

In recent years we’ve seen a blurring of the lines that once separated restaurants and bars. Concepts like Beauty & Essex, Tao and Catch have all experienced tremendous success incorporating nightlife, entertainment and event-type experiences into their restaurants.

In our existing establishments, we’ve experienced the demand firsthand for an elevated, social dining experience to complement our nightlife/entertainment/event focused venues which lead to the development of our SVCS RENDERED concept.

It’s no secret that profit margins in alcohol service are substantial.

What differentiates SVCS RENDERED, is that our concept is firmly rooted in nightlife and entertainment, which carry significantly higher profit margins and dramatically lower labor costs, setting the economic foundation for our business model and social dining platforms.

The restaurant industry is notorious for a high failure rate. One dimensional operations rely on a singular revenue stream to sustain operations leaving them vulnerable to market fluctuations, adverse economic factors and changing consumer trends.

Unlike the restaurant businesses, it is an extremely rare occurrence for a 2AM licenced bar with entertainment in a prime location to fail. These licences are very rarely issued, highly valuable, and often fetch prices well north of $1,000,000.

The economic advantages of our business model are significant. The primary capital investment (licensing, buildout, startup costs) as well as fixed operational costs including rent, utilities, insurance, admin and G&A are covered by our nightlife business segment which is highly profitable by nature. The addition of our dining program carries a relatively minimal start up investment, and provides economic and employment diversity. The dining programs drive significant food and alcohol revenue during weekend brunch, evening happy hour, mid-evening dining, as well as special and private events. The result is a highly efficient business model with a diverse revenue stream and significant cost reductions per business segment.

The operational advantages are also significant. The diverse and relevant nature of our model affords us the ability to invest in the highest caliber management and retain the best mixologists, bar tenders, wait, kitchen and service staff. Additionally we are able to leverage economies of scale through multi-unit volume discounting for liquor, beer and wine, as well as marketing, advertising, executive management and event promotion synergies.

MARKET/DEMOGRAPHICS

North Park is booming. The area is one of San Diego’s oldest commercial districts and following $148,000,000 in state redevelopment funding culminating in 2013, the area has experienced a renaissance, and the dining and entertainment market is thriving.

We were able to secure the highly coveted NE corner of 30th St. & University Ave. which is the prime location within the North Park dining and entertainment district.

Amongst massive real estate development, an influx of new residents and businesses, our location is at the center of arguably the best demographic base of our target consumer within San Diego county, creating the perfect setting to execute our concept.

We have executed a 29-year submarket lease and secured a highly valuable, rare and unique to market 2:00AM liquor license with a 1:00AM provision to serve alcohol on approx. 1,000 sf of exterior elevated patio space fronting 30th & University. Our construction plans are complete and we are awaiting the issuance of building permits.

BACKSTORY

Our Encinitas property SHELTER is without exception an extraordinary experience. The ultra stylish design and buildout of the space is far beyond that of our competitors within the market. The venue exceeded $2m in annualized revenue at its peak with profit margins in excess of 25%. Although very profitable, it became apparent that we were leaving a significant amount of money on the table. We were only using the space to about 30% of its potential, operating primarily Thursday, Friday and Saturday nights as a high end nightlife and entertainment destination. We saw several other concepts in the market, such as Bier Garden who operates under a 12:00AM license, doing north of $4m in sales, primarily in the hours we weren’t even doing business; i.e. brunch, lunch, happy hour and early evening dining. This led to the obvious conclusion that we needed to expand our business model to meet changing consumer trends and market demand. Our experience, along with emerging trends we were seeing in New York and Los Angeles led to the development of our SVCS RENDERED concept.

• Highly experienced management team with proven track record of success

• Diverse business model blending nightlife, entertainment, social dining, mixology & events

• The prime corner location in North Park

• Rare 2AM liquor license

• North Park market is booming and demographic is ideal

• Nationally-renowned Executive Chef Thomas DiMella

• Conservative projections

FINANCIALS

Financial Expectations

Cirque anticipates the property will generate roughly $4.87 million in revenue in its first year of operations and $1.23 million in EBITDA. Cirque has conservatively forecasted the financial performance based on our historical experience, market comps, and in-depth consultation with current management-level hospitality professionals within the North Park market.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Revenue | $4,873,295 | $5,116,960 | $5,372,808 | $5,641,448 | $5,923,521 |

| Total COGS | $1,325,780 | $1,392,069 | $1,461,672 | $1,534,756 | $1,611,494 |

| Gross Profit | $3,547,515 | $3,724,891 | $3,911,135 | $4,106,692 | $4,312,027 |

| 72.79% | 72.79% | 72.79% | 72.79% | 72.79% |

| Total Operating Expense | $2,317,910 | $2,414,297 | $2,517,856 | $2,698,152 | $2,810,429 |

| Earning Before Interest & Taxes | $1,229,605 | $1,310,594 | $1,393,279 | $1,408,540 | $1,401,598 |

| EBITDA | $1,229,605 | $1,310,594 | $1,393,279 | $1,408,540 | $1,401,598 |

| 25.23% | 25.61% | 25.93% | 24.97% | 23.66% |

INVESTMENT

Investor Details

Cirque will raise $2.0 million in preferred equity that will be drawn from as needed. Raised capital will go towards acquisition, licensing, development and construction costs as well as helping cover initial start-up costs. We conservatively project $1.23 million in profit beginning the first 12 months of operation, with 5% growth thereafter through year five. We anticipate to return investor capital within 22 months of operation, deliver cash on cash returns in the 34%-37% range with an IRR in the 42%-48% range annually. Prefered investors will receive 90% of net cash flow until initial capital investment is recouped, and 50% thereafter for the duration of the investment. Additionally, an equity buyout option will be available following 36 months of operation.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| EBITDA | $1,229,605 | $1,310,594 | $1,393,279 | $1,408,540 | $1,501,598 |

| Cash on Hand | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

| 50% of contingency capital return | $150,000 | ||||

| Enterprise Valuation | $4,611,019 | $4,914,727 | $5,224,796 | $5,282,024 | $5,630,993 |

| Less: Remaining Perf Investment |

| Amount to be Distributed | $1,379,605 | $1,310,594 | $1,393,279 | $1,408,540 | $1,501,598 |

| Preferred Investment | $1,229,605 | $1,310,594 | $1,393,279 | $1,408,540 | $1,401,598 |

| Preferred Investors 90% / 50% | $1,241,645 | $903,795 | $696,640 | $704,270 | $750,799 |

| Common Investors 10% / 50% | $137,961 | $406,799 | $696,640 | $704,270 | $750,799 |

| Multiple on Investment | 3.75 | 3.75 | 3.75 | 3.75 | 3.75 |

| Preferred Cash on Cash Return | 62.1% | 45.2% | 34.8% | 35.2% | 37.5% |

| Enterprise Value % | 21.8% | 7.5% | 7.9% | 8.3% | 11.3% |

| IRR | 83.9% | 52.7% | 42.7% | 43.5% | 48.8% |